A lot of clients are surprised at the price differences between individual and group health insurance. Individual insurance is for one person or their family, and group is anything set up under a business. I’m going to cover a few scenarios, and what is the best way to save on your health insurance, individual vs group.

Is individual health insurance cheaper than group? No. In my sample, the group plan premium was 6.3% cheaper than the comparable individual plan and it also had a $250 lower deductible for an individual. In addition, the tax advantages, and employer contributions will sway the balance even more towards the group. When given the opportunity, a group plan is almost always the better choice.

Keep reading if you want to see how I compare the two options with a full review of tax ramifications of each choice. Many small business owners are considering this option individual vs group, and with the creation of QSEHRA plans, it adds more confusion to the mix.

Setting the Stage – What are the details of the comparisons?

In my analysis, I am comparing:

- Single age 51 in 08201

- Income: $39,475

- Potential tax credit of $183 monthly on the exchange

- Employer Contribution @10% of the premium. This is the minimum employer contribution allowed in NJ. I used this to make the numbers fair. It also means, that the given employee is eligible to participate on the exchange

- Horizon Omnia Silver with a Jan 1, 2019 effective date. I chose this plan because it is offered in the small group market as well as individual market. The plan names are the same, but the benefits are slightly different. The individual plan version has a higher deductible by $250 for Tier 1. $1500 for IHC vs $1250 for group.

- Omnia Silver IHC Annual Premium $7692 (without any tax credits)

- Omnia Silver Group Annual Premium $7236 (without any employer contributions)

Healthcare Exchange Tax Credit

To be eligible to purchase insurance on the exchange, you can’t be offered affordable coverage through your employer. The IRS deems the plan affordable if it will cost you less than 9.86% of your household income.

In my example, the plan will cost this individual just over 16% of their income so they will meet this test.

Also, your income must fall within the 100-400% federal poverty limit range. For a single tax filer in 2019, this amount is $12,490 to $49,960.

The tax credit is based on a sliding scale determined from your income and the second lowest priced Silver plan sold on the Exchange. I won’t go into the math of this calculation on this post, but will cover it later. For now, you just need to know that in my example, the credit is $183/month.

If you want to see for yourself what your credit could be, use my Health Sherpa link.

Group Health Tax Treatment

One of the largest advantages of group plans is that you pay your premiums pre-tax. This means that when you get your check, the take out your premium before subjecting that income to Federal, and FICA taxes. In NJ, we can’t pay premiums pre-tax, but your state might have different rules.

The tax savings on just this alone can be close to 30% of the premium for someone making $39,000. It goes up as the income rises, since our taxes are progressive.

Not only that, if you are lucky enough to have an FSA at your employer, you can your copays and deductibles with pre-tax money as well. We will leave those out for the purpose of this calculation, but it is something to keep in mind.

Individual Health Tax Treatment

With the individual health plan, you can’t pay pre-tax, but you can get a sizeable tax credit depending on your income and age.

In 2019, if you are able to itemize, you will be able to deduct the amount of premium you pay that exceeds 7.5% of your income. So if you have enough deductions to get over the standard deduction of $12,200, you will be able to deduct a portion of the premium.

To not overcomplicate the comparison, I stopped computing the taxes before any below the line deductions. This will be a true MAGI number which is what they use for calculating the Health Care Tax Credit or APTC (Advanced Premium Tax Credit).

Comparing the True Cost of the Plans

I ran a detailed analysis in Excel to show the breakdowns of the premiums and how the taxes will flow through in this calculation. They make a very large difference in the outcome in this specific scenario.

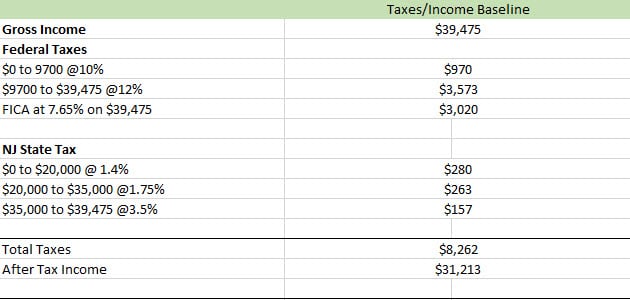

This first chart is what the individual is looking at before adjusting for any insurance premiums. Remember, this does not show what the actual tax owed or refund will be, since deductions will be taken later in the process.

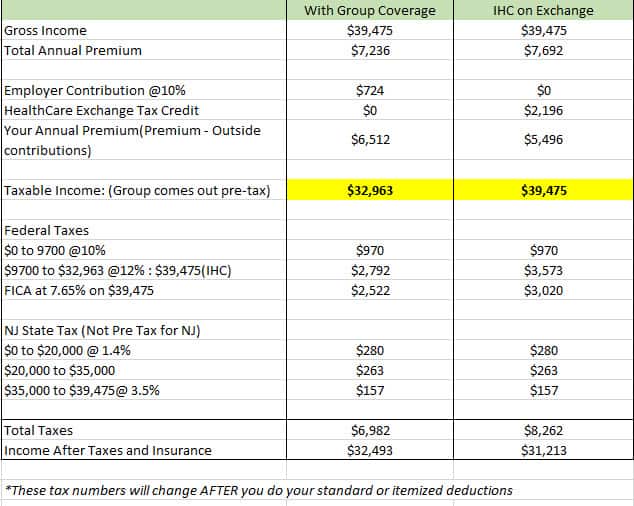

This next chart shows the breakdown of the individual vs group plans and the flow of the taxes.

You will notice I highlighted the taxable income in yellow to show the huge difference between the two.

After everything is said and done, the group plan edges out the individual by $1280 in after tax income. Keep in mind that I used the absolute minimum employer funding in this example of 10%. If the employer funded the average amount of 50% of the premium, the numbers would be thousands more in favor of the group plan.

Some of the tax calculations can be confusing, but I wanted to illustrate the level of detail that you need to get to, so you see how different scenarios will work out for you and your family.

Other Considerations

Some of the other things that aren’t shown in the numbers is the ease of doing business on the group plan vs an individual. You can’t put a dollar value on that, but with a group plan you will typically have broker working on your side and with an individual plan, you will be doing a lot more of the work on your own even with a broker.

Dealing with claims, billing etc… can become tiresome when you are going alone. I know that a group plan isn’t an option for everyone, but this is to help sway those with a choice that they should lean towards the group coverage option.

QSEHRA Plans

QSEHRA plans were offered to allow employers to make tax free contributions to employee’s individual health plan. Many employers wanted to get out of offering small group coverage or just couldn’t get enough employees interested so they had no choice, but to go the individual route.

With a QSEHRA, the employer can contribute an amount of money towards your coverage. However, what they contribute will reduce your tax credit dollar for dollar.

I need to look at these further, but they rarely work well for a variety of reasons. Ideally, it would be for higher income employees who are not eligible for the tax credit and the employer isn’t eligible to purchase group coverage for some reason.

Does individual coverage every make sense when given the option?

Yes, of course it always depends. The tax credit numbers can skew things in the favor of IHC, but you need to run the numbers.

Also, the IHC plan rates are set for the entire year regardless of when you enter into the market.

With group plans, the rates adjust quarterly. What this means is that if you start a group plan in January, a group purchasing or renewing the same exact plan later in the year will pay different rates. Since health insurance rarely ever goes down, you can expect the rates later in the year to exceed those in the individual market. In this case, you will sometimes see the IHC rates to be less than the comparable group.

Its short lived though, because the next IHC renewal will be right around the corner at January of the next year.

Related Questions

What is the difference between individual and group health insurance? The big differences are the plans that are offered and the tax treatment. Pre vs post tax for Federal taxes and FICA.

Why is group insurance generally less expensive than individual policies? The pricing of the policies has to do with the insurance companies risk pool and what their expected and actual claims are. The actuaries run the numbers and the group plans are less to maintain and thus cheaper.