Photo by Chris Liverani on Unsplash

Time to break out the calculators. Doing the math on how much a small business health insurance plan is straightforward to figure out, and with some careful planning, you can save a huge amount on the average cost.

What does a self employed health insurance plan cost? The average across the plans I surveyed in NJ is $573.37 per month. As a small business owner, you are obligated to a pay a minimum of 10% of the cost for your employees in NJ. Your cost on that is average, is at least $57.37 per month.

So what does this average cost mean? Absolutely nothing. Your actual cost will depend on a lot of factors to include the plans you choose, your zip code, the actual ages of those enrolled and how much you decide to pay. Keep reading to get some more detailed premiums and my favorite strategy to save business owners up to 30% on their premium.

Self Employed Health Insurance Premiums in NJ

The easiest way to get quotes in NJ, is to reach out to your trusted health insurance broker. Someone like myself or whoever you prefer to work with. I do not recommend working with anyone that doesn’t specialize in health insurance or is from outside the area. There are too many nuances to the plans that you need someone local to the area to make your experience a smooth one.

If you aren’t ready to reach out to a broker, the State of NJ has some great resources to calculate rates and get more information. I’m going to link to their pdf rate sheets in my guide here.

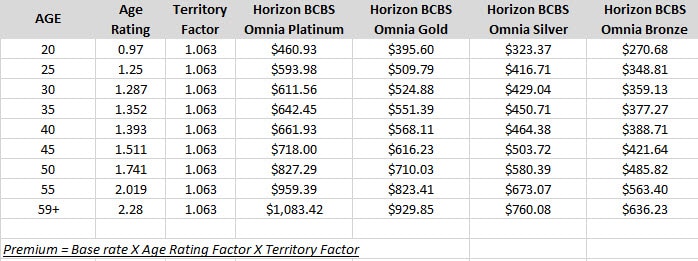

For each carrier in NJ, they will calculate the premium due for each covered member in this fashion:

Base Rate X Age Rating Factor X Territory Factor

By looking at the guides you can see clearly what age groups pay the most and also the comparison between the plans and locations.

2nd Quarter 2019 Rates for NJ

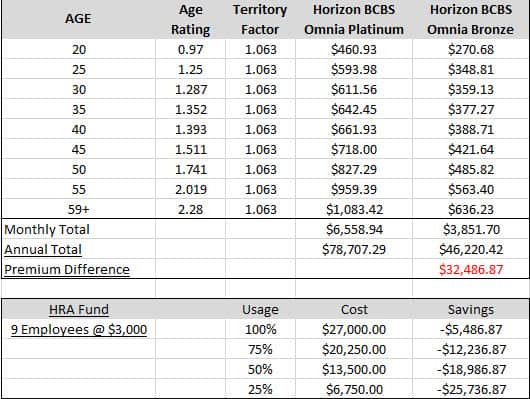

I did the math on some of the more popular Horizon BCBS plans for different age groups so you can see how the numbers stack up. This is also how I arrived at my average. It’s simply the average of the numbers below.

As you can see the premium for younger employees are less than half the cost of those aged 59+. That is why averages don’t mean much. We really need to look into the demographics of your company to get the actual rates.

Saving with an HSA

My first choice for reducing premiums for employers is to go right to the H.S.A plans. These are the lowest premium plans available without sacrificing the network of providers.

Depending on how you structure your employer contributions, you will save money when you pay a percentage of the premium or will hold steady if you pay a flat amount per month for each employee. In the second option, your employees save a considerable amount in premiums.

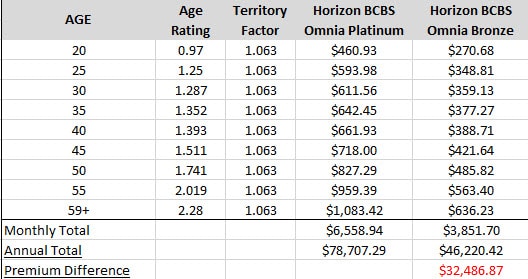

To illustrate the savings, I assumed you have one employee at age of the ages I listed in my chart above. I also assumed you are currently in the Omnia Platinum plan.

Just by moving from the Platinum plan to the Bronze H.S.A, the premium is reduced by a whopping 41%! That is really money. Over $32,000 for a group with 9 employees.

The big downside to this is that your employees had a small deductible with low copays on the Omnia Platinum. They won’t be thrilled when you move them to a plan with an upfront deductible of $3,000. Again, you have to run the numbers because each employee may be saving a few thousand dollars in premiums each year. They can use that to save for other goals if they are healthy or use the money to fund a tax favored Health Savings Account.

Saving with an HRA(Health Reimbursement Arrangement)

This is my favorite choice for business owners looking to save on their average cost of health insurance. The HRA is an incredible tool to get your employees Platinum benefits for Bronze prices.

With the H.S.A setup, you are putting all of the risk on the employees shoulders. The deductible is theirs to figure out for the most part and it can cause some grief.

With an HRA, you are setting up an additional plan to reimburse employees for their claims as they are incurred.

Setting up the HRA

With your brokers help, you will choose a third party administrator to handle the reimbursements. Their fee is usually around $1,000 a year.

For that fee they will:

- Set up the HRA Plan Documents (Needed for IRS Compliance)

- Issue Debit Cards to the Employees to use for claims

- Make direct deposits for reimbursements into employees bank accounts

- Verify all claims are valid and meet your goals for the plan.

The usual set up is the employer will fund the the full deductible for each employee and their families. You can choose any amount you wish though and can even reimburse for claims not covered by the health insurance plan. (dental, vision etc…)

Since the HRA only pays for claims that are incurred, you are not overpaying for a Platinum plan that may or may not get used. If the employees do use the plan, you reimburse them through the HRA.

Funding the HRA

Don’t worry, you won’t have to put all the money in the account at once. It works alot like an EZPass. You will put a percentage of the total HRA exposure in a separate account with the administrator. When the funds dip below a certain level, they will reach out to you to bump it back up to the minimum.

If the employees don’t have any claims, its your money to keep and use on other business expenses.

Health Insurance Cost With the HRA

Just like above, I’ll use the same plans and employee demographics.

If you remember, with the H.S.A, the premium savings were over $32,000. We are going to use that money to fund the full $3,000 deductible for each employee. Total HRA fund exposure is $27,000. If the spend all of your money, you still save over $5,000 in premiums.

I ran different scenarios to illustrate how much you can save based on the usage of your employees. I’ve never seen the full fund be used by each employee. Its incredibly rare.

What about saving up to 30%?

We surveyed the groups we have insured with the high deductible plan combined with an HRA and the trend is roughly 30% usage of the HRA. This means of the full amount the employer agreed to fund, the employees are only using 30% of that.

In this particular case, if employees used 25% of the HRA, the employer would have savings over 32%. As employees use more, that number drops but hitting that 30% number is more common than you would think.

Wrapping Up

The cost for self employed plan can vary depending on many things, but as you can see, there are some very reasonable ways to bring that average cost down. Health insurance continues to be one of the larges expenses for employer and using this tool can help save thousands in premiums per employee. Unfortunately, not all brokers will recommend this due to the fact that is twice as much work for us and the commission gets cut dramatically. Just something to keep in mind if you ask your broker, and they shun the idea. I recommend the HRA to all of my small business clients.

Related Questions

Can I get health insurance if I’m self employed? Yes, as long as you have at least one full time, W-2 employee and can meet the participation guidelines. In NJ, you need 75% of your employees to enroll or have other valid coverage.

Can my LLC pay for my health insurance? Yes, but please consult your tax professional. If you are a Single Member LLC, there may be instances where you can’t deduct your premium. If your spouse has group coverage available, that would be one such situation.